The footwear and leather sector is considered one of the most important industrial sectors in Palestine. According to industry-sector studies carried out in 2009 by the Federation of General Industries,i the investment volume in this sector is more than US$120 million.ii Although the industry is concentrated in the city of Hebron, factories operate also in other governorates such as Nablus and Gaza. The history of the shoe and leather industry in Palestine dates back to the 1960s; it reached its peak in the 1990s, when nearly 13 million pairs of shoes were manufactured and more than 10,000 workers worked directly in the sector, according to the Palestinian Central Bureau of Statistics (PCBS).iii However, the footwear and leather industry faced difficult challenges, especially in the late 1990s with the opening of the Palestinian markets to unprecedented foreign trade, especially with China, which flooded the market with Chinese shoes and left very little to the local industry, and with the breakout of the second Intifada. For example, in 2009, no more than 4 million pairs of shoes were produced and, according to the PCBS, the number of workers had dropped to 2,500.

One of the most important, built-in strengths that contributed to the development of the footwear and leather sector in Palestine is the local availability of most of the supply chain supporting the industry. Not only is the main and largest component, namely, shoe manufacture and leather tanning, carried out locally,iv many supporting industries have developed as well, including design and the manufacture of shoe soles, shoe molds, heel manufacturers, and mold makers.

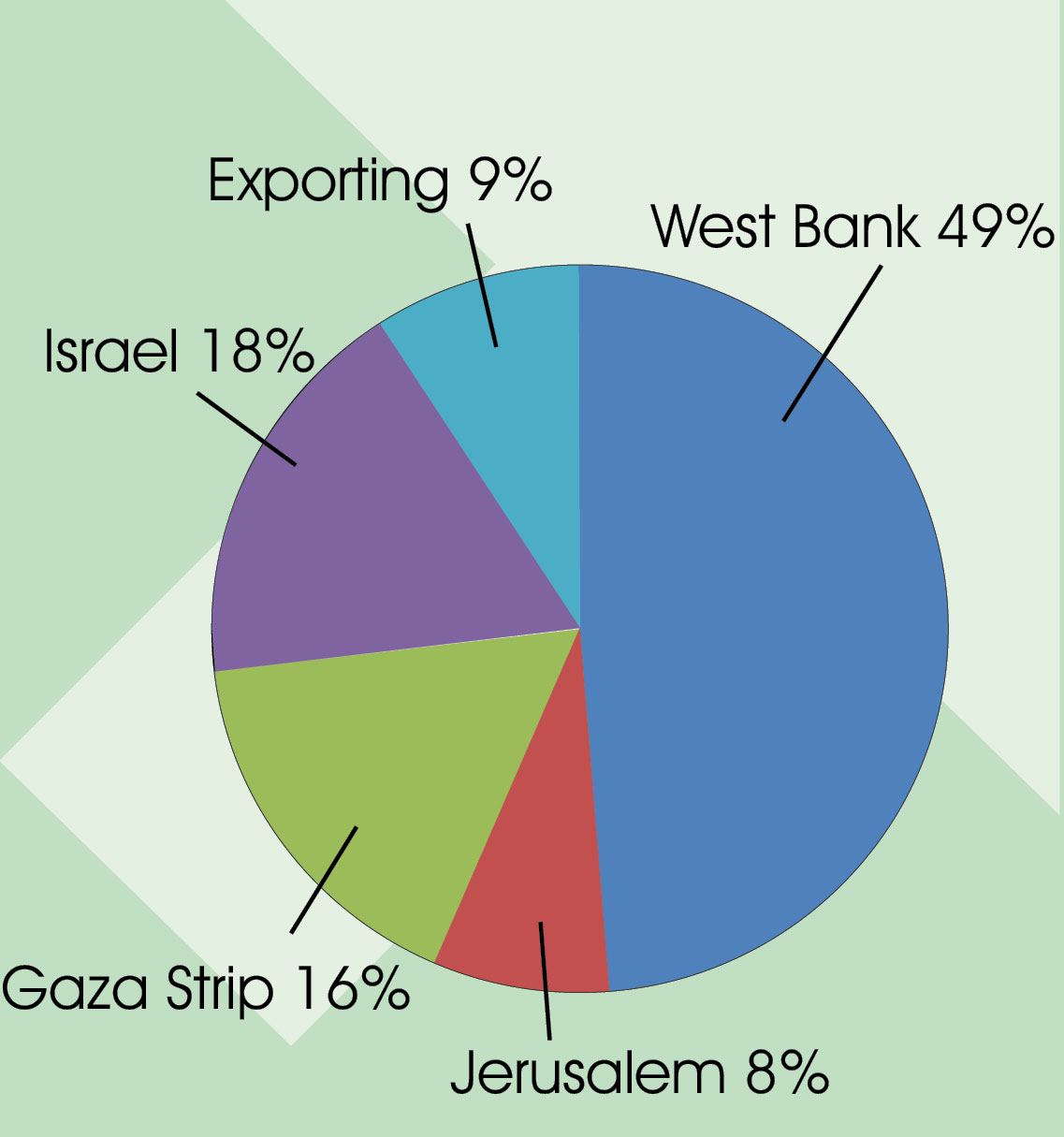

The local market is the main consumer of the products of the local footwear and leather industry. The West Bank market accounts for 49 percent; however, locally produced footwear constitutes less than 20 percent of the entire West Bank market. Gaza consumes 16 percent of locally produced footwear, Jerusalem 8 percent; 18 percent of the production goes to Israel, and less than 9 percent is exported to markets abroad.

The main countries to which Palestine exports footwear and leather products include mainly Jordan and the Gulf countries, especially Saudi Arabia, some African markets, and Yemen. Moreover, the United States purchases a limited number of products, and there is also partial export to many European countries, among them France and Italy, as well as to Japan and Canada. Although the above data are from a study carried out in 2009 by the Federation of General Industries in Palestine, they closely reflect the current situation, with a slight growth in external exports.v

Local products are generally characterized by their high quality compared to other products that are available in the local market, especially Chinese products. A study conducted by Hebron Leather and Shoe Cluster in 2015, targeting the local market (West Bank and Gaza Strip), indicated that locally produced shoes enjoy a good reputation among Palestinian consumers. The products are handmade, although there are some late stages in which industrial machinery is used. The price of local products is considered competitive when compared to imported products of the same quality.

The strength of the sector stems from the fact that it provides most of the basic production processes and support operations locally, employing domestic skilled labor, as well as geographical proximity for most of the supply chain, and diversity of products. The sector covers more than 90 percent of the types of shoes that are in demand locally, and the infrastructure that has been invested in in previous years is a strong booster for this sector.

The opening of the Palestinian local market for unregulated imports and the resulting flooding with cheap foreign goods are considered among the most serious threats that have led to the decline of this important sector, nevertheless considered one of the most active sectors of the labor force. Although the tariff for shoes was raised in 2008, the Ministry of Finance reports that in 2014 the volume of imports amounted to 17.8 million pairs of shoes in all forms, including winter slippers, and amounted to a value of US$14 million. Revenues from customs returns amounted to only US$2.8 million. The average price of a pair was US$14; divided by 17.8 million pairs this amounts to a price per pair of US$ 0.78. This number calls for some serious thinking!

The ongoing economic recession and the decline in sales have prompted manufacturers to stop investing in the development of machines at the same pace. As a result, many of the machines need to be changed or updated, and a large segment of skilled manpower has moved on to other sectors.

A number of challenges are related to the export of Palestinian footwear. The generally low educational level of workers in the sector is considered a challenge when it comes to language and communication with foreign stakeholders or agents, because correspondence and the use of e-mails are necessary in the construction of quotations, the approval and application of professional methods, and the abbreviations of export-related terms. Further challenges are associated with quality tests required by some countries, limited production capacity, political instability, high production input prices, and a lack of interest in branding.

Despite these challenges, in 2015 the footwear sector was able to become the seventh sector in terms of exports in Palestine, as shown by figures of the Palestinian Statistics Center, where $27,684,000 of shoes were exported, including to the Israeli market. This sector was listed among the promising sectors of the Palestine Export Strategy 2015.

In 2013, Hebron Leather and Shoe Cluster was established in order to develop and support the shoe and leather industry. Clusters are instruments for the promotion of industrial development, and they are defined as a geographical pool of a group of industrial enterprises engaged in a particular activity or in the production of a range of products or services. They have an integrated interrelationship between them both vertically and horizontally at all stages of the production process, thus forming the full chain of value-added product that includes the exchange of experience, data, information, and human resources.

Hebron Leather and Shoe Cluster is hosted by the Chamber of Commerce and Industry of the Hebron Governorate. It is one of the five clusters established in 2013 within the Private Sector Development Cluster Project – Palestine (PSDCP), which is implemented by the Ministry of National Economy in cooperation with the Federation of Palestinian Chambers of Commerce, Industry and Agriculture (FPCCIA) and funded by the French Development Agency.

The Hebron Leather and Shoe Cluster began with eighteen key members in Hebron. Since then, the cluster has expanded to include most of the city’s shoe manufacturers, with a comprehensive representation of the entire value chain of tanneries, chemical suppliers, designers, mold makers, shoemakers, and retailers. The footwear range includes models designed and tailored for girls, boys, men, and women, and includes all types of shoes. Manufacture includes bag making, and processes include skin skimming and the tanning of animal skins.

The cluster has adopted a systematic strategy to reach its vision of “Leather Industries for Palestine, the Arab World, and the Global Community with No Limits,” and from its inception has embarked on a series of collective projects that aim to develop and enhance the capacity of the group and improve products on the basis of international standards. The cluster products are characterized by durability, originality, and competitive prices.

One of the most important achievements of Hebron Leather and Shoe Cluster was the opening of the Hebron Shoe Shop in 2016, as the beginning of a series of shops that will spread throughout the country’s governorates. It is the first shop of its kind and involves more than 15 shoe factories from among the best factories in Hebron. Representing a long history and demonstrating experience and skill, the Hebron Shoe Shop (Soghol al-Khalil), provides only locally made shoes of the finest raw materials and the latest models, and it carries a logo that reads “from the factory to the consumer directly.” It caters to the entire family and includes a customized manufacturing service. Each factory exhibits its products on a separate shelf inside the shop.

Another remarkable achievement of the cluster is the establishment of the Leather and Footwear Products Development Center, which includes a shoe- and leather-testing laboratory, a training unit that offers a professional diploma in the shoe industry, a design unit based on the latest design methods, and a computer-aided design/computer-aided manufacturing (CAD/CAM) and information unit. This center was established based on a memorandum of understanding that was signed in 2014 between Palestine Polytechnic University, Hebron Chamber of Commerce and Industry, Hebron Leather and Shoe Cluster, the Ministry of National Economy, and the Federation of Palestinian Leather Industries.

The challenges that face the shoe and leather industry in Palestine are critical and require that all parties, especially the government, intervene to support the sector. During a visit to Turkey, organized by the Hebron Leather and Shoe Cluster in order to learn more about the corresponding sector in Turkey, it was found that the Turkish government takes measures to protect local industries by imposing a high customs tariff, building a system of speculation, limiting the export of leather in order to provide sufficient quantities to the local industry at competitive prices, and offering many incentives to participate in international exhibitions. The cluster has been able to help build the capacity of the sector, provide assistance in many technical and administrative aspects, address weaknesses, and invest in many opportunities. However, the main shortcoming in this sector is the unregulated import of goods. If the government does not intervene to find a radical solution to the issue, the sector will not be able to sustain itself in the coming years.

i With funding from USAid.

ii The Current Status of Industrial Sector in Palestine, available at https://www.ppu.edu/ppuittc/sites/default/files/The%20Current%20Status%20of%20the%20Industrial%20Sector%20in%20Palestine.pdf.

iii Mentioned in “Footwear and Leather Sector Export Strategy 2014-2018,” available at https://www.paltrade.org/upload/multimedia/admin/2014/10/5448e7eea5ba1.pdf.

vi About 60 percent of the leather used in the sector is tanned locally from hides obtained in Palestine and Israel. The remaining leather is imported ready-to-use from Italy and Turkey.

v Ibid. The relationship of the number to the current situation is the suggestion of the author, since there is no updated study available.