Take a stroll down the streets of the old city in Ramallah, or a hike in any of the hills surrounding it, and you will see evidence of just how deeply rooted Palestinian stone is in our history. For centuries Palestinian quarries have produced a wide variety of stone types with varying colors, smoothed, polished and intricately cut; they were used to build the homes of our grandfathers in the past and will continue to build the homes of our children in the future. The beauty of Palestinian stone does not lie just in its quality or its varying colors, but also in its origin: our stones possess a holy nature that is coveted not just by Palestinians but by citizens across the world. But can Palestine respond and satisfy the world demand for stone and marble from the Holy Land?

Many countries are rich in oil, while others are rich in minerals and metals. Palestine is unique in that it is rich in stone. According to the State of Palestine National Export Strategy for stones and marble,1 the reserves in the sector are valued at US$ 30 billion, which reflects its enormous export potential. The currently operating quarries are concentrated around the cities of Hebron and Bethlehem, but there exists an abundance of other reserves located in Area C, “with estimated deposits of some 20,000 dunums of quarry-able land.”2 However, because they are under Israeli control, there are heavy restrictions regarding the obtaining of new mining permits or the renewing of existing ones. Should these restrictions be lifted, it is estimated that the industry will double in value and contribute an additional US$ 241 million to the Palestinian GNP.3 Yet, and despite this limitation, Palestine is ranked as the twelfth largest producer of stone and marble in the world, producing twenty-two million square meters of goods annually (from one hundred million tons of raw stone), and the labor productivity in the sector is almost five times that of other sectors.4

♦ Palestine is the world’s twelfth largest producer of stone and marble that is renowned for its quality, colors, and holy land origins. It leads exports by being the largest export sector in Palestine which, even though it faces numerous constraints, has in place the building blocks necessary to ensure its future thriving.

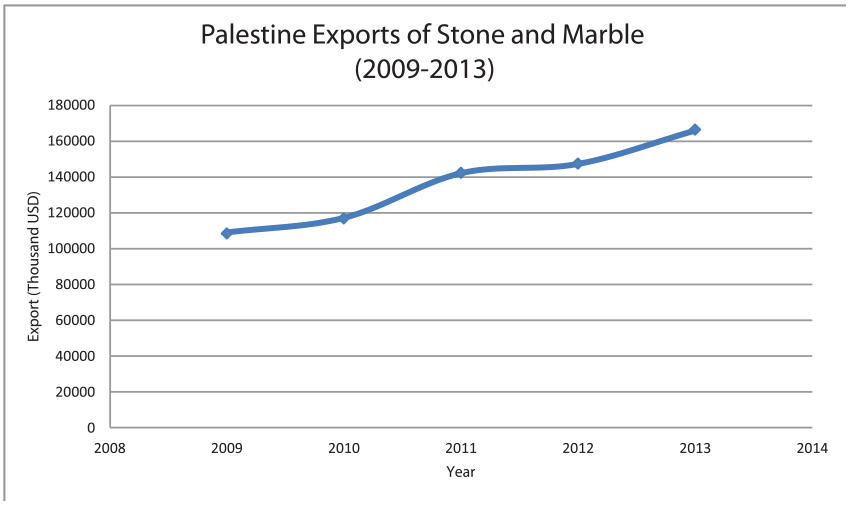

To meet its export potential, the Palestinian stone and marble sector has established a solid infrastructure that is capable of meeting the demands of international trade, as it has built the capacity to meet large orders and obtained the international quality certification ISO 9000:2000. Enterprises in the sector can be divided into three categories according to their specific activities: quarries (300), stone and marble factories (750), and workshops (600).5 Employment in the sector ranges between 15,000 and 20,000 employees, and more than 99% of the sector’s employment base is male.6 In 2013, Palestinian exports of stone and marble reached US$166.3 million, continuing an upward trend that had started back in 2007. Between the years 2012 and 2013, exports grew by 12.85% and targeted twenty-five countries around the world. According to the National Strategy for stone and marble:

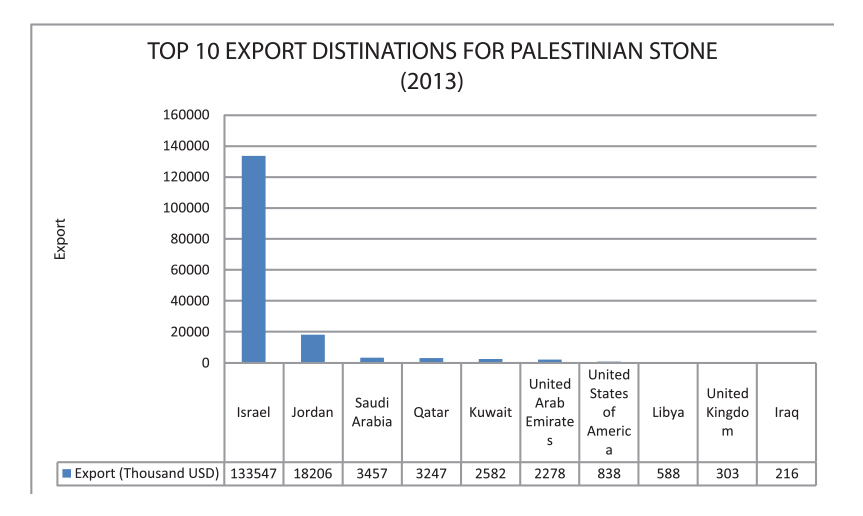

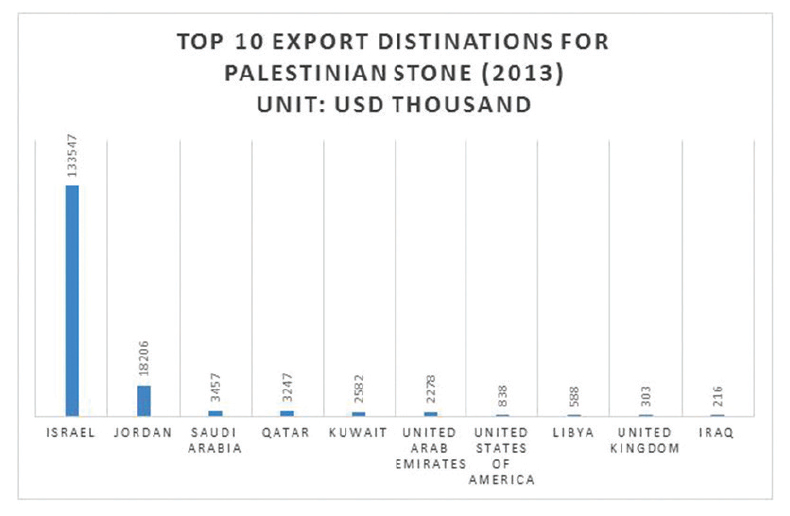

“Israel remains the primary market for the sector’s products, driven by years of existing relationships and geographical proximity to customers. The latter is especially pertinent given the weak logistical capabilities of the Palestinian exporting base. A portion of the product exported to Israel is re-exported (both with and without rework), while the majority is used in the construction sector. Other major markets for Palestinian stone and marble products include Jordan and the United Arab Emirates (UAE). Limited export relationships also exist in Qatar and Italy.”7

“Competition in international markets is increasing and directly affecting Palestinian exports. In Arab markets, Palestinian enterprises face competition from Indian, Iranian, and Turkish marble. In Europe, Palestinian exports compete with Italian and French marble, while Brazilian, Mexican, and Argentinean marble are the main competitors in North America. Competition from low-cost producers from countries such as China, Jordan, India, and Turkey is also sharply on the rise.”8

The stone and marble sector faces a number of constraints which include: high fuel cost required for the quarrying of stones, high cost of electricity, outdated production lines, irregular water supplies, inadequate waste management systems, limited numbers of qualified and skilled labor in quarries and cutting factories, complicated and lengthy licensing and registration procedures, as well as complicated logistical procedures at the borders adding to both costs and time needed to clear products. In targeted export markets the sector faces a limited network base, which makes it difficult to identify international buyers and further prolongs dependency on the Israeli market.9

♦ The Palestine Trade Center (PalTrade) was established in 1998 as a non-profit, membership-based organization that aims at contributing to the achievement of a viable Palestinian economy by developing and promoting Palestinian exports. PalTrade’s purpose and mission is to lead in the advancement and sustainable increase of Palestinian exports by providing a wide range of services in the area of export development, and by ways of market intelligence, export promotion, and trade policy and advocacy for both, Palestinian exporting and potential exporting companies,.

Yet despite it all, the Palestinian stone and marble sector still remains the number one exporting sector in Palestine, both in terms of pure dollar value and in terms of penetration of export markets. Other major achievements include the development and endorsement of the above mentioned first Palestinian stone and marble Export Strategy that identifies the problems faced by the sector and delineates the way forward in terms of strengthening its infrastructure, building its capacity, and identifying priority export markets. Development in the sector is a collaborative effort of various local institutions, with input from international institutions, that include The Union of Stone and Marble (USM), the Palestine Trade Center (PalTrade), the Ministry of National Economy (MONE), and the Marble and Stone Center (a TEVT), the first center of its kind in Palestine that provides training for workers in the sector and performs the laboratory testing for the sector’s products that is necessary for exporting.

Throughout their participation in international stone and marble exhibitions, Palestinian companies have displayed high-quality products and thus raised awareness for both the Palestinian Stone and Marble Sector and Palestine itself: In 2013, the Nassar Stone Company won the “Master of Stone” award at Marmomacc in Verona. Other accomplishments include the beautiful mural that was done by the Arts of Carved Stones Company and decorated the walls of our Palestinian exhibition at Marmomacc, Verona in 2014. The Arts of Carved Stones Company and the Jerusalem Stone Group were also featured among the ten most exciting exhibitor stands in the Middle East Stone Show in 2015, chosen out of 230 participating companies.10

The Palestinian stone and marble sector combines Palestinian heritage with a modern outlook and capability. It boasts considerable exporting experience both in terms of value and of number of export markets; and it already has the building blocks necessary to secure a prosperous future: a union that represents the interests of the stone and marble companies, a testing and training centre in Hebron, and finally an export strategy that lays down the sector’s priorities, goals, and most importantly its vision “Towards an export-oriented and globally competitive Palestinian stone and marble industry.”

» Mohammed Al Ram’ah is a Market Intelligence Officer at PalTrade. Al Ram’ah worked as a project coordinator for the first Palestinian Export Strategy which helped create a five-year roadmap for Palestinian export sectors. He is available at tradeinfo@paltrade.org.

1 Palestine Trade Center, Palestinian Ministry of National Economy, The International Trade Centre, et al, (2014), State of Palestine National Export Strategy: Stone and Marble – Sector Export Strategy 2014-2018.

2 Union of Stone and Marble (USM).

3 World Bank, (2014), Area C and the Future of the Palestinian Economy, http://www.worldbank.org/en/events/2014/01/12/area-c-of-the-west-bank-and-the-future-of-the-palestinian-economy.

4 Palestine Trade Center, Palestinian Ministry of National Economy, The International Trade Centre, et. al, (2014).

5 Ibid.

6 bid.

7 Ibid.

8 Ibid.

9 Ibid.

10 The Big 5 Hub, (2015) IN PICTURES: Ten of the best ME Stone 2015 exhibitors, viewable at https://www.thebig5hub.com/news/2015/may/in-pictures-ten-of-the-best-me-stone-2015-exhibitors/