Prior to 1994, the occupied Palestinian territories were served by two Israeli banks and one Jordanian registered bank. Palestinians shied away, however, from dealing with the Israeli banks, and thus the territories were basically under-banked, and residents and businesses were forced into a cash-based economy. The number of banks currently operating in the State of Palestine stands at 14: 8 Palestinian banks, 5 Jordanian banks, and 1 Egyptian bank. This is compared to 21 banks that operated in 2000 – 11 Palestinian banks, 7 Jordanian banks, 1 Egyptian bank, and 2 foreign banks. As the number of banks has dropped from 21 in 2007 to only 14 in 2019, the trend of mergers and acquisitions continues, and more banks are expected to exit the market.

Total deposits placed with all banks on December 31, 2018* amounted to US$12.2 billion, up from US$4.6 billion in 2007, which represents 165 percent of growth. In 2007, deposits made to Palestinian registered banks amounted to US$1.2 billion, or 26 percent of the total deposits. Whereas in 2018, deposits made to Palestinian registered banks amounted to US$6.9 billion, or 57 percent of the total deposits, which represents an increase of 475 percent between 2007 and2018. Thus, the banking sector has exhibited a remarkable compounded annual growth in deposits (liabilities) at 17 percent and compounded annual growth of 21 percent in loan portfolios (assets). These are multiples above global rates.

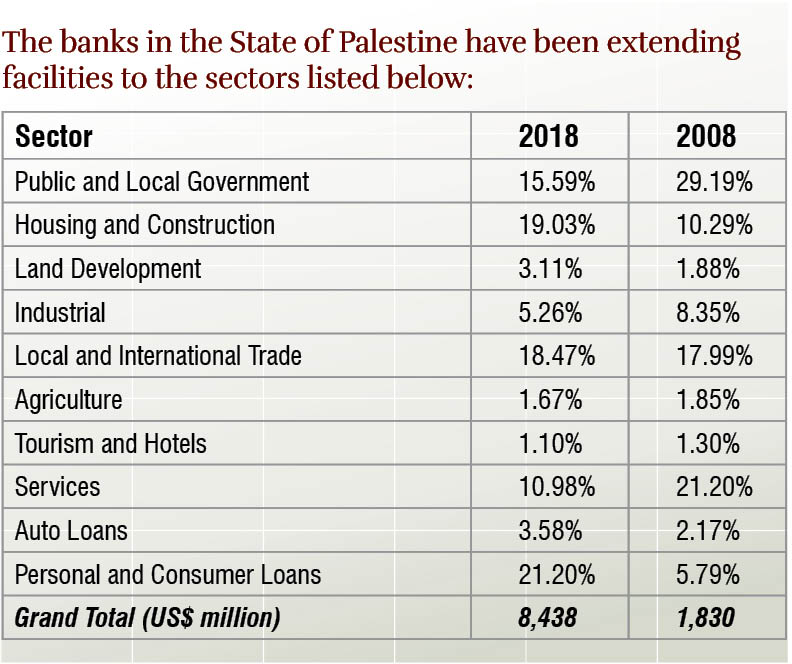

Total facilities (loans) extended on December 31, 2018, by all banks amounted to US$8.4 billion, up from US$1.42 billion in 2007, which represents 492 percent of growth. In 2007, loans extended by Palestinian registered banks amounted to US$0.60 billion, or 42 percent of total deposits, whereas in 2018, loans extended by Palestinian registered banks amounted to US$5.02 billion, or 61 percent of total loans. This represents a 737 percent increase between 2007 and2018. Thus, Palestinian registered banks today control 57 percent of customer deposits and extend 61 percent of the loans, compared to 26 percent of deposits and 42 percent of loans in 2007.

The above-mentioned growth in the balance sheet of banks was accompanied by an increase in the expenses incurred by the banks. Total expenses, excluding provisions for bad loans, increased from US$203 million in 2013 to US$438 million in 2018. This represents a 117 percent increase. Total revenues for the same period increased from US$295 million to US$696 million, a 135 percent growth. The efficiency of the banks continues to be a source of concern, however, because the expenses incurred to produce the revenues have consistently been above 65 percent, compared to global efficiency rates of 30 percent to 35 percent. Furthermore, the Weighted Average Net Interest Margin (NIM) for all the banks operating in Palestine over the past 5 years has ranged between 6.5 percent and 6.9 percent. The average NIM for US banks ranged between 3.4 percent and 3.8 percent. This means that banks in Palestine charge their customers higher interest than banks in other countries.

All banks in Palestine are mandated to adhere to the following requirements (listed in order of importance):

1) They must comply with all Palestinian laws and PMA regulations.

2) They must safeguard the deposits and best interest of their depositors (fiduciary responsibility).

3) They must ensure efficient and effective operations to support and strengthen the national economy.

4) They must produce acceptable returns on their investors’ capital.

Overall, it can be noted that, with the exception of the efficiency ratios, the banking sector in Palestine has accomplished much over the last years, and the PMA, through its oversight and regulations, has offered depositors great comfort in knowing that their deposits continue to be safe and the liquidity of the banks has remained within acceptable parameters.

The banks will have a major role to play in efforts to contribute to economic recovery once the pandemic has ended, a task that is especially daunting given that basic conditions prior to the outbreak of COVID-19 were less than ideal. The Palestinian economy suffers from one of the highest unemployment rates in the world. The unemployment in the third quarter of 2019 registered 25 percent of the labor force; 42 percent in Gaza and 13 percent in the West Bank. (In comparison, before the Corona pandemic, Israel’s unemployment stood at a mere 3.4 percent.) Another very important indicator is the per capita income in the Palestinian Territories (PCI) which lingers around US$3,000/year. This is fifteen-fold below the PCI in Israel, which exceeded US$43,600 last year. Total deposits placed with Palestinian banks amounted to just above US$12 billion, which is around 3 percent of the US$371 billion in deposits that are placed with the 22 banks operating in Israel (16 Israeli banks and 6 foreign banks).

This anomaly between the Palestinian and Israeli economies has existed for many decades and was further magnified when the PLO and Israel signed the 1994 Paris Protocol titled “Protocol on Economic Relations between the Government of the State of Israel and the P.L.O., representing the Palestinian people.” Essentially, the protocol integrated the Palestinian economy into the Israeli economy through a customs union, with Israel having control over all borders, both its own and those of the Palestinian Authority. Palestine remains without independent gates to the world economy. The protocol regulates the relationship and interaction between Israel and the Palestinian Authority in six major areas (customs, taxes, labor, agriculture, industry, and tourism), with the result that Palestinians have become subjected to the same price structure as the citizens of Israel.

Going Forward: What should we expect from the banks after the end of the Corona pandemic?

Construction, land development, car, and personal loans combined account for 47 percent of the total outstanding amounts, government for 16 percent, and trade finance and letters of credits (L/Cs), 18 percent. On December 31, 2018, these three categories accounted for around 81 percent of the loan portfolio, whereas all other categories, i.e., services, agriculture, tourism, and industry combined, accounted for a meager 19 percent of the portfolio. Furthermore, PMA regulations dictate that 9 percent of the deposits have to be placed as reserves with the PMA and another 6 percent of the deposits must be kept as liquidity reserves in the banks’ vaults.

In order for banks to contribute to the economic prosperity of the State of Palestine, they have to change their lending habits and concentrate on productive sectors that create employment and reduce the need for imports that consume our foreign currency reserves. The areas needing bank support are mainly agriculture, tourism, transportation, renewable and solar energy, education, and small industries, to name just a few. All these areas require small investments to create employment and increase per capita income for Palestinians.

For the banking sector to contribute effectively and efficiently to the building of the economy, the actions considered necessary to be undertaken as soon as possible encompass the following:

• Lending policies should allow for more lending to productive sectors.

• The Net Interest Margin should be lowered so that existing and future borrowers can take out (and pay back) loans more easily in efforts to recover from this crisis.

• It is recommended that the reserve requirements, as per PMA regulations, be temporarily reduced to unleash the necessary liquidity for corporate and new businesses to continue operating during this crisis.

• Repayments from existing loans should be lent to sectors that are economically feasible and generate the required cash-flows, allowing them to comply with repayment schedules and create more employment opportunities.

• The Ministry of Economy and the trade unions should take an active role along with banks to identify future lending opportunities.

• The major banks should establish new departments for loan syndications that will allow the financing of major projects.

• The Ministry of Finance should help corporations and small businesses by looking for ways to reduce their income tax burden and settle the amounts that are pending and still due to suppliers who have provided services and delivered supplies to the government and its ministries.

Finally, the PMA is encouraging financial inclusion and expending great efforts to make it easier for people who never had a bank account to open one. This will have many positive outcomes for both parties. Account holders will have access to all bank products, and banks will be able to source new inexpensive deposits and lower banking fees.

The Palestinian banking sector has successfully managed to increase the banks’ balance sheets, assets, and liabilities; safeguard the interest of the depositors; and generate an acceptable rate of return for its shareholders. It will definitely play the expected role in the future to further support the economy by lending prudently, which shall lead to higher GDP, control inflation and rises in consumer price indexes (CPIs), and reduce unemployment.

The Palestine Monetary Authority has been very effective in regulating the banks and will have a larger role to play in the future.

*The audited financial figures for 2019 were not yet available at the time this article was written.