Palestinian civil society plays a crucial role in improving the livelihoods of Palestinian citizens, whether through the provision of services or assuming the role of a watchdog over the government. Within this framework, civil-society lobbies, relevant duty bearers, and advocates for the improvement of policies and legislation engage in a wide array of issues such as gender equality, youth empowerment, labor rights, and public financing.

While civil society organizations focus extensively on service provision, gender equality, and youth empowerment, work on public financing remains limited in terms of the number of organizations that focus on it and the scope that is covered. The Palestinian Initiative for the Promotion of Global Dialogue and Democracy (MIFTAH) works on issues that pertain to public financing in line with its strategic priority to advance policy advocacy and lobbying to ensure social justice and equality, as well as transparency and accountability.

MIFTAH’s work in this area comes within the context of several indicators that reflect that there is significant room for improvement in governmental policy that aims to contribute to the realization of social justice. For example, while budget allocations in 2018 for the Ministry of Education and Higher Education (MoEHE) stood at 20.2 percent of the public budget, allocations for the Ministry of Health (MoH) and the Ministry of Social Development (MoSD) remained below par and stood at 11.33 percent and 8.87 percent, respectively. Furthermore, actual expenditure rarely, if ever, equals the budget allocation, such that in 2018, actual expenditure by the MoEHE, MoH, and MoSD stood at only 80 percent, 94 percent, and 86 percent, respectively, of the allocated budget. This shortage in expenditure may be attributed to the complicated and bureaucratic financial procedures and requirements identified by the Ministry of Finance (MoF) that do not take into consideration the needs and circumstances of marginalized and vulnerable communities and groups, among other factors.

In addition, the persistence of the Israeli occupation has not only hindered and prevented the development of a viable Palestinian economy, it has also rendered the Palestinian Authority unable to exercise sovereignty over public revenues and the wider framework of public finances. For example, the Paris Protocol gives full control to Israel over the collection and transfer of clearance revenues, which, according to the expenditure data released by the MoF, amounted to 72.9 percent of the tax revenues in 2018. Tax evasion, too, is prevalent and widespread in Palestine, particularly among free professions, and its estimated rate stands at at least 35 percent; this in turn increases the tax burden on committed taxpayers and individuals.

The inability to build a viable Palestinian economy, as well as the issue of tax evasion, has led to insufficient revenues to finance the public budget, which manifested in a public budget deficit that stood at ILS 2,714,600,000 in 2017. This deficit is predominantly shouldered by the social and infrastructure sectors, directly impacting the livelihoods of Palestinians.

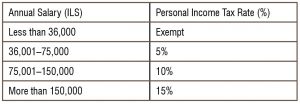

Surprisingly, the taxation system in Palestine does not include concrete policies and measures to address tax evasion nor does it contribute to shifting public revenues to more reliable and stable sources, such as income tax. This shift would certainly require due consideration of adopting pro-poor fiscal policies that ensure an equitable distribution of the tax burden. In the current situation, the proportion of income tax to total tax revenues stood at 8.32 percent in 2018. This minimal contribution can be attributed to two main reasons: first, in order to encourage investments, companies are given tax exemptions and deductions, such that the contribution of Corporate Income Tax (CIT) to the total tax revenues did not exceed 4 percent over the past three years. The second major factor is the absence of progressivity in the identification of tax brackets at the level of both CIT and Personal Income Tax (PIT), taking into consideration that the contribution of income tax exceeds 40 percent in progressive systems of taxation. In contrast, currently, the CIT rate is fixed at 15 percent and rises to 20 percent for a few monopolistic companies, whereas PIT brackets and rates are distributed as follows:

Despite the Palestinian government’s declared priority of “Citizen First” in the 2017−2022 National Policy Agenda, poverty rates stood at 29.2 percent in 2017.i Furthermore, it can be clearly observed that the current fiscal policy in terms of taxation and spending requires significant improvement to fulfill the governmental responsibility of equitable distribution of services as well as to contribute to the realization of social justice.

MIFTAH’s work on fiscal justice and advocacy is evidence-based and comes in two main directions: reform of taxation policy and promotion of transparency of public spending, with a specific focus on social spending. MIFTAH’s work on taxation policy commenced with a focus on income tax.*2 This expanded when MIFTAH undertook the research project of the Fair Tax Monitor*3 to include several aspects of taxation; including 1) tax burden and progressivity, 2) revenue sufficiency and tax leakages, 3) corporate tax exemption, 4) effectiveness of tax administration, 5) government spending, and 6) transparency and accountability. Furthermore, with the view to promote specialization and concrete advocacy and intervention efforts, MIFTAH zoomed into the areas that are most relevant to its strategic priorities of promoting social justice: tax burden and progressivity*4 and government spending.*5

On the other hand, MIFTAH’s work on fiscal transparency commenced in 2015 with the MoSD and led to the release of the first Palestinian Citizen Budget by the ministry in 2016.*6

The Citizen Budget is a simplified document of the general budget. Expressed in numbers, figures, and graphs, the Citizen Budget summarizes the key expenditure policies, approaches, and priorities of the ministry for the upcoming year. Following a conciliatory approach that is characterized by complementarity, this work expanded to include MoEHE*7 and MoH*8 in 2017 and 2018, respectively. With the aim of institutionalizing fiscal transparency and a participatory approach in planning and budgeting, MIFTAH has continued to support these ministries as well as developed a Citizen Budget Preparation Manual to serve as a future reference document for all three ministries.*9

Alongside the release of the Citizen Budget, MIFTAH has worked on the development of fact sheets on specific and relevant issues within the framework of the work of the aforementioned ministries, including budget allocations for the poor, social sector budgets from 2016–2018, and MoH budgets from 2016–2018. MIFTAH’s efforts in this regard seek to familiarize various stakeholders, and primarily civil society organizations, with budget allocations and priorities. Furthermore, in line with its mission of “…adopting mechanisms of active and in-depth dialogue, the free flow of information and ideas, as well as local and international networking,” MIFTAH seeks to foster dialogue on these issues with the view to influencing fiscal policy towards increased social spending and social justice.

Another tool employed by MIFTAH in its advocacy work to influence policies is public mobilization. Naturally the type of tool employed relies predominantly on the issue to be addressed and the optimal method to generate pressure on Palestinian duty bearers. Through research and an evidence-based approach, MIFTAH and partners identify goal(s), demands, and messages and thereafter develop tools and interventions. For example, the “Money4Medicine” campaign demanded the allocation of sufficient budgets to allow the MoH to address medication shortages. As such, the campaign sought to mobilize the maximum number of signatories towards this end, including in festivals, in the city centers, and through cultural activities. The campaign reached over 40,000 signatories, with the pressure generated leading the MoF to transfer ILS 65 million to the MoH to cover medication debts, as well as the allocation of ILS 280 million in 2018 for medication.

Ultimately, the philosophy behind MIFTAH’s advocacy work is to empower and enable duty-bearers with the knowledge, skills, and tools that will enable them to fulfill their responsibilities, and thereafter hold them to account. The effectiveness of this philosophy is contingent on the adoption of a conciliatory and participatory approach, alongside ensuring that all advocacy interventions are evidence-based and substantiated.

*1 Poverty Rate Among Individuals in Palestine according to Monthly Consumption Patterns by Region, (in Arabic) PCBS, 2017, available at http://www.pcbs.gov.ps/Portals/_Rainbow/Documents/Levels%20of%20living_pov_2017_01a.htm.

*2 Proposed Reforms to the 2011 Income Tax Law and Its Amendments, MIFTAH, 2017, available at

http://miftah.org/Publications/Books/Proposed_Reforms_2011_Income_Tax_Law_EN.PDF.

*3 Fair Tax Monitor, Make Tax Fair, 2016, available at https://maketaxfair.net/ftm/.

*4 Tax Burden from the Viewpoint of Tax Justice (in Arabic), MIFTAH, 2018, available at

http://miftah.org/Publications/Books/Tax_Burden_From_the_Viewpoint_of_Tax_Justice.pdf.

*5 Governmental Spending on the Social Sector form the Viewpoint of Social Justice (in Arabic), MIFTAH, 2018, available at http://miftah.org/Publications/Books/The_Governmental_Spending_on_the_Social_Sector_from_the_viewpoint_of_Social_Justice.pdf.

*6 Citizen Budget, MIFTAH, available for the following ministries: http://miftah.org/Publications/Books/CitizenBudget2016.pdf; MoSD 2017 at http://miftah.org/Publications/Books/CitizenBudget2017En.PDF; MoSD 2018 at http://miftah.org/Publications/Books/Citizens_Budget_2018_MoSD_EN.pdf.

*7 MoEHE 2017: http://miftah.org/Publications/Books/CitizenBudget2017BEn.PDF; MoEHE 2018: http://miftah.org/Publications/Books/Citizens_Budget_2018_MoEHE_EN.PDF.

*8 MoH 2018:http://miftah.org/Publications/Books/Citizens_Budget_2018_MoH_EN.pdf.

*9 MoSD: http://miftah.org/Publications/Books/Citizen_Budget_Preparation_Manual_in_theMoSD.pdf; MoEHE: http://miftah.org/Publications/Books/Citizen_Budget_Preparation_Manual_in_the_Ministry_of_Education_and_Higher_Education.pdf; MoH: http://miftah.org/Publications/Books/Citizen_Budget_Preparation_Manual_in_the_Ministry_of_Health.pdf.