The fixed broadband market in Palestine is currently led by ADSL connections that are provided mostly by the incumbent Paltel through its Internet Service Provider (ISP) Hadara. End users have to subscribe to Paltel to benefit from a phone line and then subscribe to internet access services. They can choose among nine existing ISPs that have developed their own fiber infrastructure and fixed-wireless infrastructure to deliver broadband and VoIP, mainly to professional and corporate customers. Four companies provide connection to their customers through Wi-Fi or microwave links. Fiber services, however, are only available in private networks such as the ones of Rawabi or Rehan suburbs as well as the fiber network of the Jerusalem District Electricity Company.

However, in order to be able to invest in infrastructure, there are certain requirements, such as having a specific National Broadband Plan (NBP) that takes into account the diversity of geographic regions and the factors surrounding them. The ministry/regulator should provide the private sector with clear policies and legislation to regulate the sector and clear incentives to promote investment. This cannot be realized without real partnership and cooperation with the ministry and among the stakeholders.

The 10 Gigabit Full Duplex DOCSIS effort aims to smash the rollout of fifth-generation cellular technology 5G hype by demonstrating how much faster cable networks can be in delivering symmetrical speeds as high as 10 Gbit/s to the home. In the absence of the flexibility of development of the Palestine mobile broadband (3G/4G), Palestinian efforts should be concentrated to increase the availability and speed of the fixed broadband. Here, Paltel is dominating the sector and has a well-structured network and infrastructure. It is worth mentioning Paltel’s achievement of linking the Palestinian network through the Italian submarine cable with Turkey in September 2012.

Countries at different stages of ICT development tend to have different priorities and scope for their NBPs. Countries in a relatively early stage of ICT development tend to focus on supply-side initiatives, building network infrastructure availability and encouraging widespread internet usage (demand-side impact). On the other hand, countries in a relatively more advanced stage of ICT development are more likely to have a greater focus on demand-side measures and embed ICT into the national society and economy.*1 In Palestine, our goals should be largely focused on the supply side that aims to provide broadband coverage nationwide. And once we have made significant progress in terms of ICT development, our future plans can be focused on demand-side initiatives to embed technology more deeply into society and the economy. Supply-side targets typically aim to ensure that the physical network infrastructure is in place to deliver high-quality broadband access to the whole country or at least large parts of it.

In most countries, governments set the targets but then rely mainly on private-sector investment to deliver the infrastructure. The government role in such cases is largely to facilitate rollout through enabling measures and frequently by providing public funding for broadband coverage in non-commercially viable areas. Effective government actions should focus on the stimulation of private funding and commercial activities. They should play an important role in the central coordination of initiatives, in monitoring progress, and in ensuring that the plan’s goals be achieved. In Palestine, special measures should be taken to ensure that internet access is available in rural areas. Demand-side targets should be set in a range of sectors, including e-government, education, and health.

ICT infrastructure involves several components: the human infrastructure, the legislative infrastructure, and the physical infrastructure of networks and components.

Investing in infrastructure can involve investing in basic networks, distribution networks, access networks, cell towers, and satellites.

A new Palestinian NBP, based on the principles of access, collaboration, and effective investments, will help drive supply of advanced broadband infrastructure. Access to reliable, high-quality, and affordable services is necessary for success in a digital world. Enhancing investment in the infrastructure and services provided by the sector will encourage new players to enter and invest in the ICT sector. Regulatory directives should be developed to promote and encourage the sharing of ICT infrastructure, together with issuing instructions to expand the infrastructure to include all areas to ensure access to all services.

Another advantage would be ensuring the provision of high-speed, high-quality broadband internet services in all governorates, especially in remote and isolated villages and behind the separation wall, at reasonable prices through developing a broadband policy document. Fiber total cost of ownership (TCO) materially is lower than copper or copper upgrade. It is also better, especially for customers, to move away from copper-generated 2x-5x traffic – the internet is more useful. It has greater value and will lead – over time – to greater pricing power. It also has a greater economic impact and benefits as well as flexibility through special platforms for subscriptions to increase the number of users and thus revenue. It should be noted that there is no technology risk with fiber and Active Ethernet. A fiber infrastructure will serve the country for the next 50 to 80 years, so “Do it right, do it once.”

Israeli restrictions on the import of civil and ICT material across borders (especially in Gaza), difficulties to obtain permits to operate in Area C (infrastructure deployment and maintenance), and restriction on access to international links (possible only through an Israeli-registered company) are all factors that affect investment in infrastructure, in addition to the dominant position of Paltel in selected segments and the service provision by unauthorized Israeli operators. Some competing ISPs consider it more cost-effective to duplicate the fixed infrastructure rather than access Paltel’s infrastructure. Palestinian operators also face strong constraints in Area C as they cannot provide “microwave backhauling” (i.e., wireless links used to connect the last-mile network with the backbone).

In the 2014 ICT Strategy for Palestine, the government adopted as a national project the addition of empty ducts for the usage of future fiber optic networks when roads or streets are rehabilitated and water, electricity, and sewage lines are laid both within municipalities and between cities. The main cost of deploying fiber is typically the civil works required for underground fiber. The author succeeded in convincing the cabinet to take a decision to request that the Ministry of Public Works lay the ducts when rehabilitating any street between cities.

Experts stress that despite the current political situation and heavy-handed Israeli restrictions, the ICT sector stands above other economic sectors in terms of its readiness to boost the Palestinian economy and significantly penetrate regional and international markets.

There is great potential for broadband in Palestine. The total number of ADSL subscribers in Palestine increased to 357,071 at the end of 2017, compared with 119,488 at the end of 2010, an increase of 198.8 percent. The average internet speed was 8.58 Mbps at the end of 2017, compared to 0.5 Mbps at the end of 2010. Translating projected internet penetration into numbers, internet users in Palestine will reach 1.9 million and internet subscribers will reach 6.4 million in 2031. Approximately 11 percent of the GDP makes up for an ICT market size of more than US$ 600 million.

Recently, Jerusalem District Electricity Company (JDECO) has entered the telecommunications market and laid optical fiber cables over its electric grid to manage and control remotely its electric supply. This operation is known as a smart grid. Optical fiber cables have far larger transition capacity to fulfill the company’s needs. As a matter of regulatory policy, the Ministry of Telecom and Information Technology of the State of Palestine (MTIT) granted JDECO the permit to lay the fiber cables for JDECO’s own use but on the condition that the company give licensed telecom operators the right of access. Considering JDECO is a Palestinian company with offices in Jerusalem (Israeli-registered), the optical fiber cables as well as the electricity conducted in these cables cross the wall from Jerusalem to areas in the West Bank, including areas defined as Area C. This can give the Palestinian telecom operators a good chance to provide their services to locations that they have not been able to reach so far since JDECO’s coverage area covers only the center of the West Bank. Electric companies in other parts of the West Bank and in the Gaza Strip have a chance to do the same as JDECO. JDECO was not allowed to sell services and facilities, however, its telecom subsidiary needs a license in order to provide access to its fiber network in a non-discriminatory fashion to telecom operators. ISPs also have developed their own fiber infrastructure and fixed-wireless infrastructure to deliver broadband and VoIP, mainly to professional and corporate customers. Israel has full control of what is allowed and what is not allowed and has the tools to reinforce its decisions through the control of importation of technology.

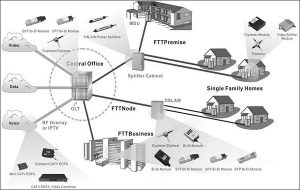

Fiber to the x (FTTX) is a generalization for several configurations of fiber deployment, arranged into two groups: FTTP/FTTH/FTTB (fiber laid all the way to the premises/home/building) and FTTC/N (fiber laid to the cabinet/node, with copper wires completing the connection). Some of the drivers of the FTTH market include mobile backhaul,*2 where fiber will be necessary to deal with the development of mobile data consumption and leapfrog from 2G to LTE. Another driver is the low quality of existing networks, where the copper networks are generally not efficient enough to support the provision of value-added services such as TV and video. A third driver is cloud services for small and medium enterprises (SMEs) and small office/home offices (SOHOs) that are heavy users of new and innovative services, among them cloud-storage solutions. The trust in the networks is a key parameter, and FTTH/B infrastructure is a good answer.

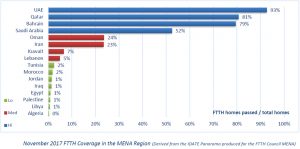

National broadband network (NBN) investment is dedicated to fiber because this is the only technology that is future proof and provides the high speeds increasingly needed by businesses, consumers, and the public sector. The MENA region is very diverse economically, ranging from the wealthy Gulf through emerging economies to the extremely difficult situation facing conflict zones. In terms of broadband infrastructure, at one end of the spectrum lies the United Arab Emirates, which now utilizes all fiber, whereas at the other end there are countries that still have significant areas without any (or only basic) service.

An NBN policy is often taken to mean establishing a new network infrastructure organization. But creating a completely new organization that is able to tackle a once-in-a-lifetime infrastructure project is a considerable challenge in its own right. There are nine key dimensions of any NBN policy. Clearly, the best policy in any particular country will vary depending on local circumstances. In Palestine, each municipality could make sure that the areas under its control are well connected by ensuring the installation of fiber backbone and microwave links without waiting for external actors. Municipalities can also add solar-power panels to their street-lighting poles and wireless network to ensure citywide Wi-Fi. In addition, mesh wireless networks, which are not dependent on centrally located towers and can bypass obstacles such as hills, are a promising new avenue for municipalities.

The advantages and importance of investment in infrastructure can vary from the development of durable infrastructure to the keeping abreast of advanced technologies to meet citizens’ needs for services.

Investment can open the opportunity to find new markets and services and thus increase the number of employees and cause an increase in gross domestic product.

JDECO and Palestine Investment Fund’s telecommunication subsidiary partnered together in order meet the exponential demands for higher bandwidth by providing high-quality fiber broadband to large enterprises, ISPs, and mobile network operators with access to a state-of-the-art fiber network. They are still waiting to get a license as facility provider from MTIT. But is MTIT ready for this with the right regulations, procedures, pricing, and full licensing regime?

Despite all the obstacles, this sector is a promising sector, and it is hoped that it will thrive in the coming years, enabling it to play a vital and strategic role in the promotion and development of the economy, improving the performance and production of other production sectors in quantity and quality, and developing the methods and outputs of the education sector, as well as facilitating citizen access to basic services remotely through electronic services. For municipalities and communities, Gigabit Broadband will become the economic engine driving investment and job growth, while drastically improving education, healthcare, and community services, and providing the pathway for all Palestinian cities and towns to become Smart Cities.

*1 Benchmarking 15 national broadband plans.

*2 The term backhaul is used to describe the entire wired part of the network.