The importance of information and communication technology (ICT) is not limited to its own field but is critical in promoting other areas and industries. It is considered to be an enabler for all other sectors by adding a new dimension to the development process that leads these sectors to prosper.

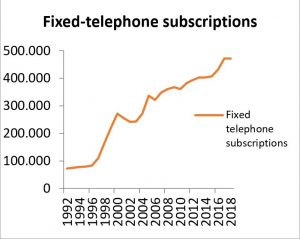

Palestine has been a part of the global race for leadership in ICT despite the severe situation of continuous occupation. In the early days of telecommunication development, Palestinians struggled for survival and lived without a significant ICT footprint beyond the rare usage of radio receivers. In the 1960s and 1970s, Palestinians watched Arab TV channels from Jordan, Syria, Lebanon, and Egypt. The telecom sector, however, was under the control of the occupation authority, which tightly restricted the fixed-telephone network penetration. In 1993, following the signing of the Oslo Agreement, Palestinians managed to gain control over the telephone network in the West Bank and Gaza. When the Telecommunication Law (No. 3 of 1996) was passed, it gave the Palestinian Ministry of Telecommunication and Information Technology (MTIT) the mandate to set up and regulate the telecom sector. The ministry began to operate, regulate, and manage all aspects of this important sector – with the exception of new-frequencies allocation, which is still occupied by Israel – and the sector expanded rapidly. When MTIT gained authority over the telecom sector, there were only 75,000 fixed-telephone subscriptions in Palestine. Since then, the number of fixed-line subscribers has increased significantly, as illustrated in Fig.1 (Fixed-telephone subscriptions 1993–2018).

The privatization of the Palestinian telecommunication network in 1996 and the establishment of the Palestinian Telecom Company (Paltel) attracted a considerable amount of private investment in order to develop and expand the network. In 1995, Palestine had been introduced to the internet, which was initially used mainly to connect universities but which rapidly gained in popularity. One year later, Palestinians began to use internet services with speeds from 28 to 56 Kbps using residential and commercial telephone lines. In 2004, Subscription Free Internet (SFI) was introduced using fixed telephone lines, followed in 2005 by the introduction of ADSL with speeds of up to 1 Mbps. In 2010, ADSL lines could provide speeds up to 2 Mbps to a limited number of ADSL subscribers.

In 1999, Jawwal was ready to launch its cellular mobile telephone services in the West Bank and Gaza. The expanding services of mobile and fixed telephony along with internet services had a large impact on the young Palestinian economy, connecting the West Bank and Gaza and creating a new way to overcome the problems caused by both a weak infrastructure and the Israeli occupation authority’s control over mobility. Without the opportunity to use ICT, many organizations and companies would not be able to reach remote areas, and people would not be able to benefit from governmental services.

In 2007, Wataniya Mobile (Ooredoo) was licensed by MTIT as the second mobile operator; it could not launch its services, however, until the release of its frequencies that were allocated by Israeli authorities in 2009 and limited to the West Bank only, excluding Gaza at that time.

The Palestinian ICT market is focused mainly on fixed telephony, cellular mobile and value-added services (VAS), DSL for broadband internet, and IPTV. New IT companies are increasingly emerging, creating jobs in fields such as graphic design, web design, mobile applications, and database management. Some of these companies utilize the Palestinian human capacity to market their services overseas.

A major challenge was to provide Wataniya Mobile with the frequency required to launch its services. Another challenge was to obtain the 3G frequencies required for both mobile operators to work in both the West Bank and Gaza. It was not until 2017 that Wataniya was allowed to bring its equipment to Gaza as the second operator there. In the same year, the 3G frequency was released to be used by both operators in the West Bank, but Gaza remains deprived of mobile broadband internet use.

Notably, by the end of 2018, around 55 percent of Palestinian households had internet connection with an average DSL line speed of 13.29 Mbps, a top speed of 100 Mbps, and 8.6 Mbps for the internet connectivity;* household internet usage increased from 40 GB per month in 2014 to 127 GB per month in 2018. Currently, 13 Internet Service Providers (ISPs) are offering internet services and IPTV, and some other companies are offering VAS. The international internet capacity for Palestine also made a great leap during the same period, jumping from 40 Gbps to 149 Gbps, and the backhaul connection (links between Paltel and ISPs) grew by 577 percent from 40 to 271 Gbps. In addition, we can boast of a notable development in the telecommunications infrastructure as the fiber optics network grew by 52 percent from 2,300 to 3,500 km, which is reflected in the improved quality of services and in the recently introduced availability of 3G services in the West Bank and of 2G services for both mobile operators in Gaza. The growth in the telecom sector and the fact that the majority of new start-ups engage in ICT has confirmed it as a promising sector for the national economy: The number of establishments that work in ICT increased by almost 60 percent, from 629 to 1,008 businesses, and the number of employees who work in ICT grew by 23.44 percent, from 7,453 to 9,200 employees between the years 2014 and 2018. Prices have significantly decreased in the past few years, by about 70 percent for DSL access and 250 percent for internet subscriptions; voice calls have decreased in price by about 40 percent, and the price of 1GB of 3G data is now less than 5 NIS for some programs and even much lower for high-capacity programs.

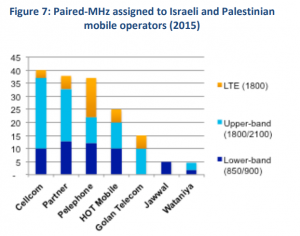

In 2019, Israel still occupies frequencies, as well as all other natural resources. Hence, the telecom sector continues to face very tight restrictions and challenges. Israeli policies impede the progress of the sector by posing challenges to network operators and service providers in Palestine, thereby preventing Palestinians from keeping up with new technologies. Spectrum control and restrictions on frequency allocation stymied for many years the ability of Palestinian operators to offer 3G and more services. Even now, after the release of the 3G services in early 2018, far less spectrum is offered to Palestinian operators than to mobile operators in Israel. Israeli mobile operators are already using 4G spectrum, which enables them to offer more advanced services than their Palestinian rivals. When Jawwal was established in 1999, it was allocated 4.8 MHz of spectrum in the 900 MHz band to serve an approximate predicted 120,000 subscribers. Until the end of 2017, Jawwal was still operating on the same band allocated in 1999, but subscribers have grown to about 3 million, compared to 120,000 in 1999, and the same for Ooredoo that served its subscribers using only 1.8 Mhz in the 900 MHz band and 2.4 MHz at 1800 MHz band, that was for 2G services until 2017. As a result, Palestinian operators had to cope with a very high frequency load and were forced to spend additional capital to build extra towers in order to maintain their services. Israeli operators, on the other hand, are using much larger allocated frequencies, as illustrated in Fig. 2.

(Source: World Bank, 2015).

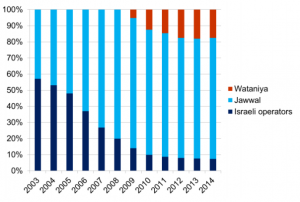

Israeli restrictions on importing telecom equipment and the prevention of bringing mobile switching equipment to Palestine add significantly to the operating costs for all networks. Jawwal and Ooredoo have to maintain equipment in other countries and route all calls to and from those switches, which adds to costs and significantly affects service quality. Furthermore, the illegal competition posed by Israeli operators in the Palestinian mobile market in the West Bank adds another challenge to the telecom sector. The estimated market share of Israeli operators in the Palestinian mobile market amounts to about 15 to 20 percent as estimated in 2015, and they offer both 3G and 4G services. The construction of mobile network facilities (including 3G/4G) in the illegal Israeli settlements in the West Bank means that Israeli companies are able to sell their mobile services in significant parts of Palestine. The market share of Israeli operators compared to Palestinian operators is illustrated in Fig. 3.

operators in the West Bank

(Source: World Bank Estimates, 2015).

The protracted and often unsuccessful applications for permissions to construct facilities in Area C add significant transactional cost and result in the need to fall back on highly inefficient routing of much traffic within Palestine. Moreover, the need to rely on Israeli carriers for connectivity between the West Bank and Gaza and international locations further increases the cost and significantly affects the quality. The refusal of Israeli authorities to allow any of the Palestinian companies to install and operate an international gateway adds costs and cuts off a major source of revenue − and most importantly deprives Palestinians of their basic right to have an independent international gateway and independent numbering plans, all of which are currently controlled by Israeli authorities.

In 2018, the International Telecommunications Union (ITU) in its Plenipotentiary Conference (PP−18) in Dubai passed resolution 125 (Rev. Dubai, 2018) that resolves to urgently provide assistance to Palestine in order to enable it to obtain and manage the radio spectrum required to operate its telecommunication networks and wireless services, to give support for Palestine’s utilization of new modern mobile and fixed systems and networks − such as IMT2020 − and associated radio frequencies, and to support the establishment of Palestinian international gateways.

The exceptional situation of Palestine has its own consequences for the structure of the economy and industries. Israeli tight restrictions on borders and ports restrict the import and export of goods, trade activities, and movement of people. This affects the prospering of all Palestinian industries and is the reason that some barely survive, especially given the illegal competition posed by Israeli products and services in the local Palestinian market.

Since it occupied Palestine in 1967, Israel has controlled all natural resources, preventing Palestinians from benefiting from the wealth of their own country. Implications of the Israeli restrictions and the nature of ICT as an industry that relies mainly on knowledge and human capital as its natural resources makes this sector an important, promising field to drive Palestinian development towards a knowledge-based economy and pave the way for a better and sustainable future. This is aided by the fact that the Palestinian community is young, with only 5 percent of the population over 60 years old, where illiteracy amounts to barely 3.1 percent, and in which, moreover, around 4 percent of graduates are specialized in computer science and IT and 8 percent in engineering.

* The internet connection consists of two components: 1) The DSL line, which is the pipe (infrastructure) through which information flows (provided by fixed operator Paltel). 2) The internet connectivity, which is the access to worldwide internet (provided by ISPs).